Qi Quai Report, Updating kQuai, Blockchain, Active inference, Cost of computing, Economics of maintenance, Cryptocurrency panel, Modeling QiQuai

Quaiscan block explorer and block visualizer allow inspection of blocks

Questions

- Dashboard Why is the price of quai currently lower than the price of qi?

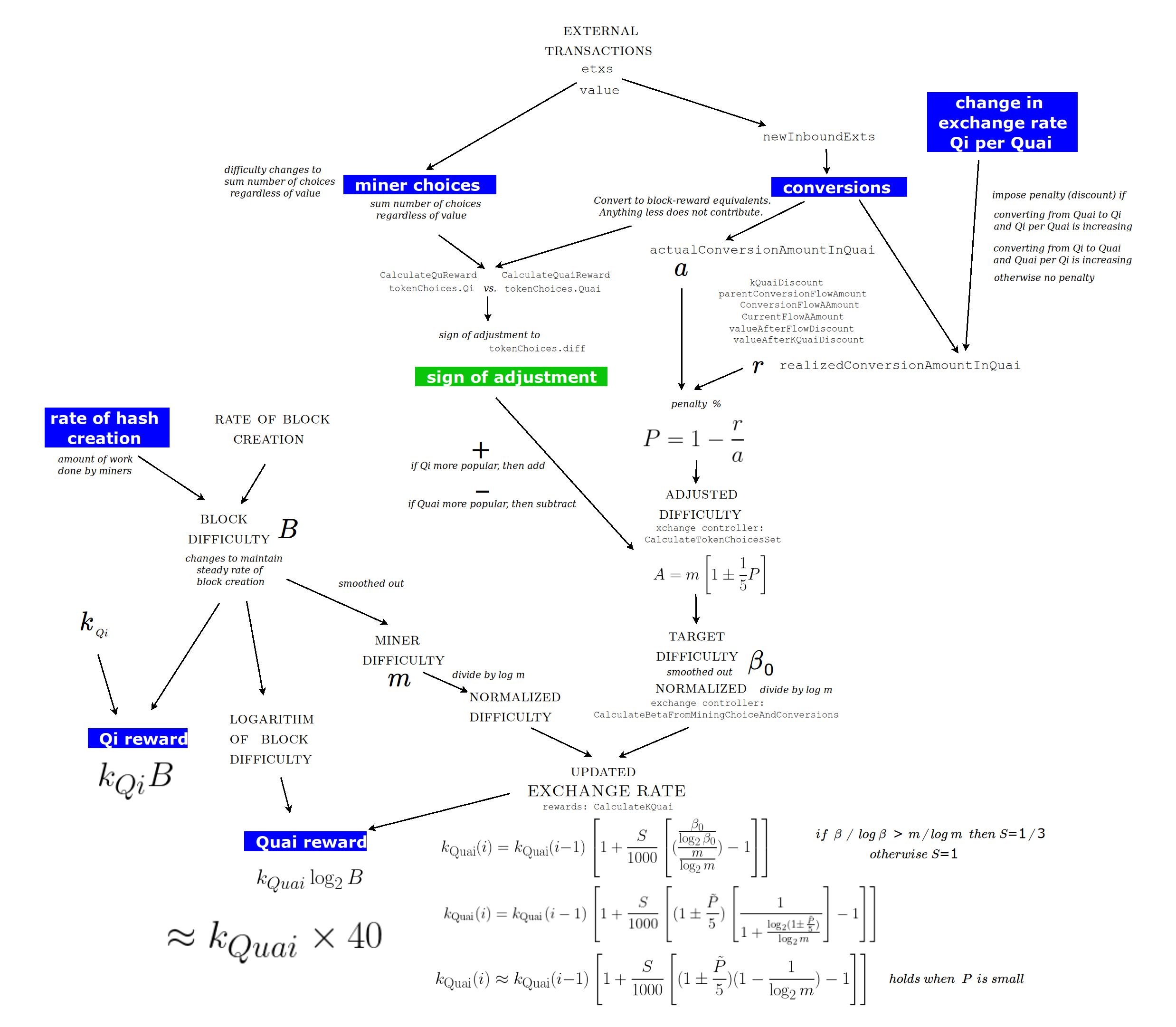

- If difficulty is less than expected, then quai is underpriced, and it makes sense to choose quai. So then why in exchange_controller.go is the algorithm lowering the difficulty if people are prefering quai ?

- In the case of if Quai is chosen more than Qi, the difficulty (miner difficulty) is shifted downwards and in the case of Qi being greater than Quai the difficulty is is shifted upwards.

- Where is discussed the option of being rewarded with qi for work done even if you don't create the block?

Goal: Distill an exposition of Qi and Quai in terms of

- Problem: want endogenous pricing, independent of fiat currencies

- Principle: bimetallism, Gresham's law

- Analogy: relate them to entropy and free energy, or kinetic and potential energy

- Formula: formulate a useful calculation such as for a Kalman filter

Qi Quai

Qi Quai Rewards

rewards.go CalculateReward

forks to CalculateQiReward and CalculateQuaiReward

rewards.go CalculateQiReward

- quotient of difficulty and params.OneOverKqi(header.NumberU64())) = 8 × 10^9 x (1 to 4)

rewards.go CalculateQuaiReward

- exchange rate times log of difficulty

- Qi: Issuance rate proportional to hash, tied to mining difficulty, making it a proxy for energy costs. (Stable price)(Medium of exchange)(Fixed denominations, no scripting)(Emissions on logarithmic curve.)

- Explanation of Qi emissions and exchange protocol.

- Rewards are issued in direct proportion to the energy (hash) difficulty required to mine blocks.

- Think of difficulty as a proxy for energy costs.

- When mining becomes more energy-intensive (higher difficulty), Qi rewards increase proportionally to compensate miners. When energy costs decrease (lower difficulty), Qi rewards decrease accordingly.

- Rewards are issued in direct proportion to the energy (hash) difficulty required to mine blocks.

- GPU efficiency (measured in flops) doubles every 2.69 years due to smaller transistors and increased core counts, plateauing after 2030. Qi adjusts accordingly.

- Explanation of Qi emissions and exchange protocol.

- Quai: Issuance rate linked to bits of difficulty, increasing at a diminishing rate to create scarcity. (Exponential growth in price)(Store of value)(Smart contract capabilities)

- Quai emissions Quai uses a logarithmic emission curve. Token inflation remains below value creation - maintaining deflationary pressure.

- block reward proportional to log-base-2 of difficulty (number of leading zeroes in the target value).

- The constant of proportionality evolves with the launch of Qi, becoming more dynamic through the controller system for Quai/Qi conversions.

- Can convert qi to quai or quai to qi at the protocol rate.

- When there is demand for qi, it is mined (if it is more expensive than the production rate), and quai is converted to qi.

- When there is a surplus of qi, then it is burned to mint quai.

- Conversion

- The block reward function determines potential Qi emissions, but miners choose whether to receive Quai or Qi rewards. This means Qi supply reflects actual demand from miners, who typically choose based on market conditions and utility needs.

- Anyone can convert between Qi and Quai at the current mining reward ratio - not just miners.

- According to Kishore Satpute

- actualAmount: the amount submitted by the user in the conversion transaction. This is the raw input they asked to convert.

- realizedAmount: the amount that the user actually receives.This is what ends up credited.

- Game theory view

- Mine quai when the difficulty rate is lower than average. Mine quai when the difficulty rate is higher than average.

Selling points

- Get rid of MEV (maximal extractable value), relevant for decentralized finance, defi, DEXs (decentralized exchanges)

- Can dynamically increase supply transactions with demand and guarantee that if you mint an NFT (non-fungible token) it will stay at one penny, relevant for https://rarible.com to guarantee low price large quantity mints over time

- Payments: Decentralized scalability and stability (endogenous unit of account)(because linked to the price of electricity)(relevant for unstable nation state currencies)

Mechanism for consensus

- Proof of entropy minima

- energy to computation to symbolic value transformation

Steph Macurdy

- A theory explaining the interconnected drivers of 21st-century crises, especially global catastrophic risks, and a triage strategy involving decentralized technology.

Thoughts

- An energy market is a very recent development, a consequence of globalization, electrification, the petroleum industry.

- Oil 30%, coal 28%, natural gas 23%, biofuels and waste 9%, nuclear 5%, solar and wind 3%, hydropower 2%.

- IEA Energy Supply

- Traditional fuels were wood and charcoal. Animals were used, and also wind and water. Coal was used in China in the 1200s and in Europe during the Industrial Revolution 1760-1840. Oil was negligible before 1850. Natural gas was used widely with the opening of pipelines in the 1920s.

- Energy is the ultimate store of value Consider energy reserves.

- By pegging Qi to energy costs, we create a currency with real-world stability and intrinsic worth. The energy market, in the short term, is volatile because the market is inelastic and thus very sensitive to supply and demand.

- Energy backing reduces volatility Can you convert Qi to energy at a fixed rate?

Literature

- Qi Quai documents

- Quai price history

- Brave New Coin. Quai Network - Energy-based Money for the 21st Century. 4 advantages.

- Stephen Macurdy. Thermoeconomics. about Stephen Wolfram and Karl Kreder.

- Steph Macurdy. Economic growth in the game of life.

- Steph Macurdy. Proof of Entropy Minima From Big Bang to Blockchain.

- Eric Chaisson. Free Energy Rate Density.

- https://wiki.p2pfoundation.net/Free_Energy_Rate_Density

- Eric Chaisson. Cosmic Evolution.

- https://www.youtube.com/watch?v=Troj1savkLI

- POEM: Proof of Entropy Minima. Karl Kreder, Shreekara Shastry.

- QUAI/QI Conversion Dashboard

- Wikipedia: Huang's law

- Block Science Michael Zargham worked on the Qi Quai controller.

- Project SOAP Subsidized Open Market Acquisition Protocol.

- GitHub Qi Quai

- internal > quaiapi > quai_api.go Line 1444: kQuaiDiscount := primeTerminus.KQuaiDiscount()

- core > types > block.go kQuaiDiscount is part of the block

- core > exchange_controller.go

- consensus > misc > rewards.go

- There is 100k Qi = $90,000 and 600 million Quai = $24,000,000.

- (October 17, 2025: 617 million Quai circulating and 3 billion Quai total. 130,000 Qi total.)

- 17,280 blocks/day

- 0.147 qi/block × 17,280 block/day = 2,540.16 qi/day = 927,100 qi / year

- 3.36 quai/block × 17,280 block/day ≈ 58,141 quai/day = 21,000,000 quai / year

- Qi annually mined / market cap = 927%

- Quai annually mined / market cap = 3.5%

The unit basis doesn't matter. The market cap basis is more important. Quai is 300 times larger than Qi.

High preference for Quai because there is perceived growth potential in Quai.

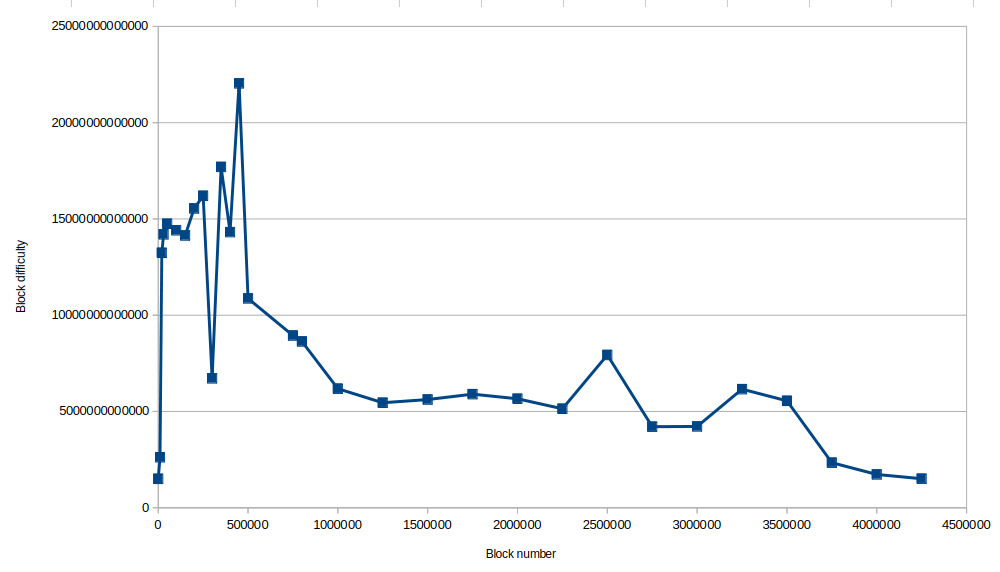

| block number | block difficulty (dec) | kQuai |

| 0 | 1,500,000,000,000 | 221077819000000000 |

| 10,000 | 2,619,986,019,334 | |

| 20,000 | 13,239,244,208,451 | |

| 30,000 | 14,200,159,575,831 | |

| 50,000 | 14,748,021,879,712 | |

| 100,000 | 14,409,073,556,407 | |

| 150,000 | 14,140,707,016,984 | |

| 200,000 | 15,542,761,800,997 | |

| 250,000 | 16,202,499,597,057 | |

| 300,000 | 6,717,307,511,179 | |

| 350,000 | 17,700,524,560,868 | |

| 400,000 | 14,314,963,321,809 | |

| 450,000 | 22,041,042,771,072 | |

| 500,000 | 10,869,096,520,046 | |

| 750,000 | 8,942,892,910,627 | |

| 800,000 | 8,634,831,998,081 | |

| 1,000,000 | 6,181,596,701,418 | 221077819000000000 |

| 1,250,000 | 5,453,639,064,368 | |

| 1,500,000 | 5,618,139,290,740 | |

| 1,750,000 | 5,898,846,438,483 | |

| 2,000,000 | 5,659,080,329,273 | 93,267,204,890,625,000 |

| 2,250,000 | 5,140,445,277,168 | |

| 2,500,000 | 7,934,394,351,797 | |

| 2,750,000 | 4,209,953,572,551 | |

| 3,000,000 | 4,220,935,502,471 | 0.375 QUAI |

| 3,250,000 | 6,158,228,381,134 | 0.446 QUAI |

| 3,500,000 | 5,552,512,284,286 | 0.221 QUAI |

| 3,750,000 | 2,338,951,815,314 | 0.188 QUAI |

| 4,000,000 | 1,726,748,263,911 | 0.136 QUAI |

| 4,250,000 | 1,507,457,828,142 |

Fields that can be read given block number

quAI: Short answer — the standard block object (eth_getBlockByNumber) exposes the usual Ethereum fields plus several Quai-specific ones. Key fields you can read:

- Identification & parents: number, hash, parentHash, nonce, mixHash, sha3Uncles, size

- Difficulty/entropy: difficulty, totalEntropy (Quai), totalDifficulty (if present)

- Gas & fees: gasLimit, gasUsed, baseFeePerGas (baseFee)

- Roots & state: stateRoot, transactionsRoot, receiptsRoot, logsBloom, QuaiStateSize (Quai EVM context)

- Miner/coinbase: miner (PrimaryCoinbase in EVM context)

- Timestamp: timestamp / time

- Transactions: transactions (either an array of tx hashes or full tx objects depending on the RPC call)

- Outbound external txs (ETXs): outboundEtxs — can be hashes or full objects (fields: blockHash, blockNumber, from, to, gas, hash, input, value, transactionIndex, type, accessList, originatingTxHash, etxIndex, etxType)

- Block-specific Quai metadata: subManifest, totalEntropy, etxEligibleSlices / PrimeTerminusNumber (prime-terminus info in EVM BlockContext)

If you call eth_getBlockByNumber you can request transactions as hashes (false) or full transaction objects (true). The Quai OpenAPI schema lists all Quai-specific fields and ETX structures for the block response; the EVM BlockContext shows what fields are available to contracts during execution (e.g., Time, Difficulty, BaseFee, QuaiStateSize, PrimaryCoinbase, EtxEligibleSlices).

Andrius: @quAI is the exchange rate affected by whether miner's choose Qi or Quai? Or is it only affected by conversions?

Short answer: both. The exchange rate is driven by miner reward choice (coinbase votes) and by conversions — they operate at different speeds and through different mechanisms.

Why — protocol summary:

- Miner choice changes the economic sign and magnitude of the adjusted/normalized difficulty that the controller uses to update k_Quai (the exchange-rate parameter). Coinbase transactions include a choice for Quai vs Qi, and the “sign” of the adjusted difficulty depends on the token‑choice majority; those difficulty statistics feed the normalized/target difficulty math used to evolve the exchange rate over the controller window (4000 blocks).

- Conversions are the fast pressure valve: conversions are normalized by the destination block reward, they affect conversionFlowAmount and receive cubic + kQuai discounts, and arbitrageurs converting between tokens directly move supply/demand and therefore the realized exchange ratio. The conversion mechanism and conversionFlow math explicitly participate in exchange‑rate stabilization.

- Token design reinforces this: miners’ reward choice determines how new supply enters (Qi vs Quai) over time, while conversions let anyone instantly swap and arbitrage to the protocol rate — so miner behavior shifts the slower, supply-side trend; conversions produce immediate adjustments and arbitrage pressure.

Net effect: miner choices matter (they bias the controller over many blocks); conversions matter more immediately (they let markets correct supply imbalances). Both together determine the exchange rate.

Andrius: @quAI I see that the function CalculateReward returns both qi rewards and quai rewards. But what is the final payout that the miner receives? What subsequent steps does the payout depend on?

- Short answer: the protocol first computes the potential Quai and Qi amounts (CalculateQuaiReward / CalculateQiReward). The miner’s actual payout is one of those amounts (not both) in the token the miner selected for that block, subject to lockup/optional multipliers and minor protocol checks. The choice and post‑processing (discounts/adjustments) determine the final spendable outcome 【rewards.go】【block-rewards.md】.

- Step-by-step what happens after CalculateReward returns a value

- Which currency is paid? — the block header’s coinbase scope / miner preference determines whether the miner receives Quai or Qi for that block. CalculateReward returns the Quai amount when PrimaryCoinbase is in the Quai ledger, otherwise the Qi path is used 【rewards.go】【node.md】.

- Lockup / maturity & multipliers — miners may choose a coinbase lockup option. Rewards are subject to a maturity/lockup period (2 weeks → up to 12 months) and longer lockups give higher multipliers (e.g., 3.5% / 10% / 25% example multipliers) — the locked reward is paid after the maturity period or registered as not-spendable until unlocked for Qi 【node.md】【protocol_params.go】【block-rewards.md】.

- Coinbase bookkeeping vs. spendable balance — Qi rewards are recorded but may be “not spendable” until unlock; Quai coinbase payouts are sent after lockup/maturity as configured on the miner/node flags 【node.md】【block-rewards.md】.

- Controller / token-choice side effects — the miner’s choice (Quai vs Qi) and conversion activity feed the exchange/controller (tokenChoiceSet, adjusted difficulty, kQuai updates). Those mechanisms change future rewards and conversion discounts but do not retroactively change a past coinbase amount 【exchange_controller.go】【slice.go】.

- Optional advanced flows — miners can lock coinbase into tranches/bonds (LMTs), use precompiles, or participate in conversion flows; conversion transactions and discounts (cubic flow discount, kQuai discount) affect protocol conversions (Quai↔Qi) but are separate from the immediate coinbase calculation【block-rewards.md】【conversions.md】【LMT.md】.